Integrations for Financial Institutions

Explore and compare integration options and approaches

Abstract

This document outlines and compares integration options for financial institutions (FIs) seeking to implement Cardlytics’ user experience within their digital platforms. Two primary approaches are presented:

-

Publisher-Built User Experience:

The FI leverages the Cardlytics API to build and host the entire user experience within its own app or website, offering maximum customization and control. This method requires significant development effort and results in a longer time to market (2-3 months). -

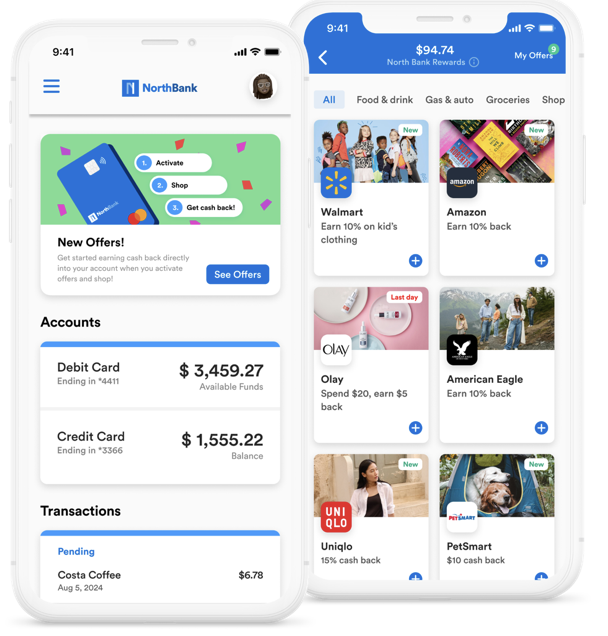

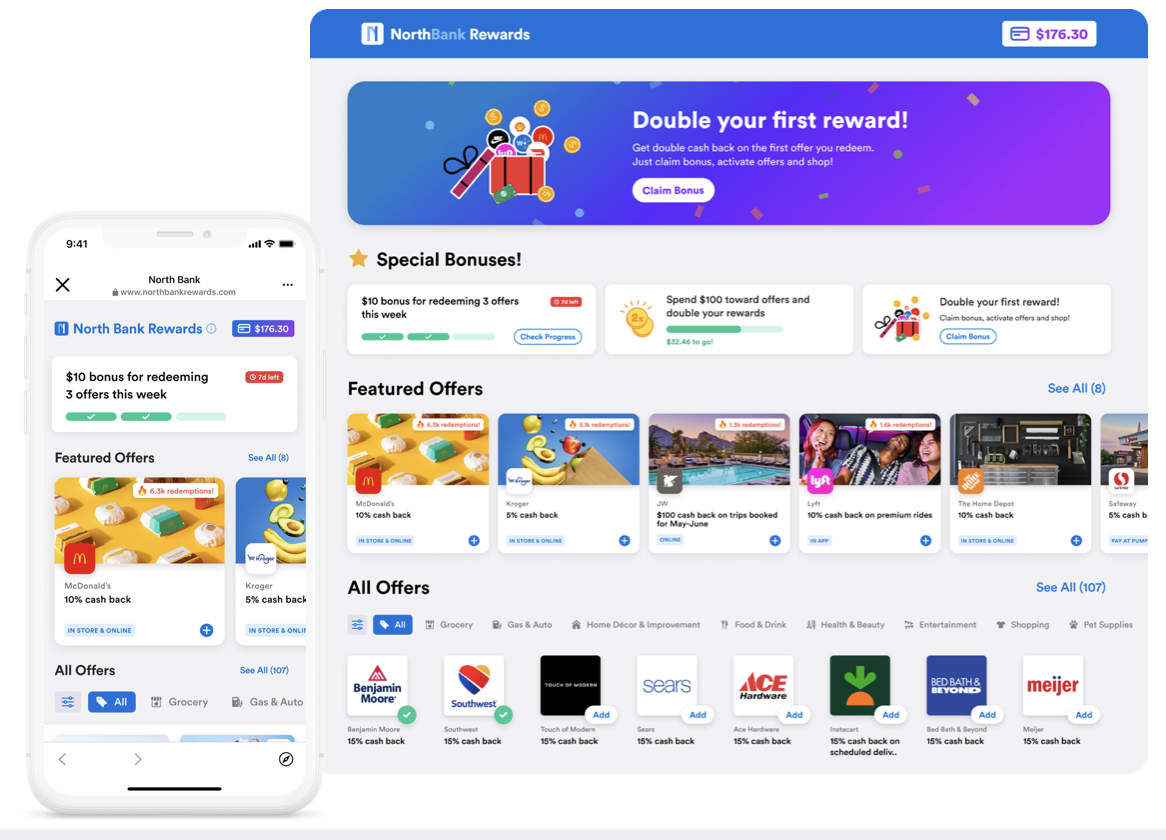

Cardlytics-Built User Experience:

The FI integrates a pre-built, white-labeled user experience via the Cardlytics SDK. This approach provides an out-of-the-box solution with minimal development work, enabling rapid deployment (2-4 weeks), but offers less flexibility for customization.

A comparison table highlights key differences in integration mechanisms, user experience control, development timelines, maintenance responsibilities, and technical resource requirements. The document is supplemented by visual diagrams illustrating each integration flow, helping FIs select the approach that best aligns with their technical resources, desired level of control, and speed to market.

Integration Options

Summary: Publisher-Built User Experience

-

Description:

The financial institution (publisher) uses the Cardlytics API to fully build and host the user experience within their own app or website. -

Key Benefits:

- Maximum control over the look, feel, and functionality of the user experience.

- Ability to customize and innovate as desired.

-

Considerations:

- Requires significant development effort from the publisher, especially for adopting new features or updates.

-

Estimated Time to Market:

- 2-3 months to launch.

Summary: Cardlytics-Built User Experience

-

Description:

The financial institution (publisher) integrates a pre-built, white-labeled user experience into their app or site using the Cardlytics SDK/Hosted. -

Key Benefits:

- Provides an out-of-the-box solution that is ready to use.

- Requires minimal development work for both initial setup and future feature adoption.

-

Considerations:

- Less control over customization compared to a publisher-built experience.

- Fastest way to launch Cardlytics features.

-

Estimated Time to Market:

- 2-4 weeks to go live.

Integration Comparison: Financial Institution

| Feature | Publisher-Built | Cardlytics-Built (Embedded) | Cardlytics-Built (Hosted) |

|---|---|---|---|

| Auth Integration required | ✅ | ✅ | ✅ |

| Transaction Ingestion | ✅ | ✅ | ✅ |

| Integration Mechanism | Cardlytics API | Cardlytics SDK/Hosted | Auth Integration |

| Location of Experience | Integrated into FI Site | Embedded into FI Site | External white labeled site |

| User Experience | Publisher controlled | Cardlytics controlled with FI header/footer | Cardlytics controlled |

| Development Time to Market | 8-12 weeks | 3-5 weeks | 3-5 weeks |

| Maintenance Required | Publisher | Limited | None |

| Auth Integration | Runs in existing publisher user session | Runs in existing publisher user session | Need to establish user session |

| Resourcing | Dev resources | Limited dev resources | Limited dev resources |

Updated about 2 months ago