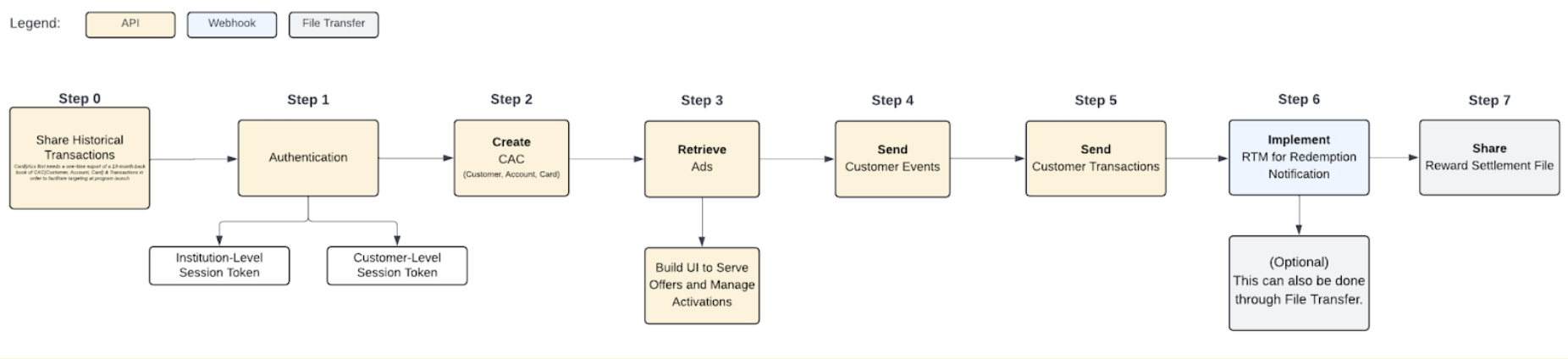

API - Integration Steps

Describes the end-to-end integration process for publishers with the Cardlytics platform

Abstract

This document outlines the end-to-end integration process for publishers with the Cardlytics platform to enable personalized rewards, ad targeting, and transaction-driven marketing for customers. The workflow begins with the secure sharing of customer, account, and card transaction data, followed by robust institution- and customer-level authentication to access API resources. Publishers proceed to onboard customers, retrieve targeted advertisements and rewards data, and capture relevant customer events throughout user sessions. The integration further includes posting customer transaction activity and leveraging real-time messaging (RTM) webhooks for immediate reward notifications to enhance user engagement. Finally, the document details the periodic reward settlement process, allowing publishers to reconcile and fund customer rewards efficiently. Each step is supported by Cardlytics API references and documentation, ensuring a structured and secure approach to delivering a seamless financial rewards experience.

Steps

Step 0: Share customer transaction data, including customers, cards and accounts.

Source: Share Historical Data CAC (Customer, Account, Card) CAC(Customer, Account, Card) & Transactions.

Step 1: Authentication

Source: Authentication: Institution-level Authentication to Create Customers or Transactions (or retrieve generic Ads?) and Customer-Level Authentication to Update Customers, Create Customer Events, do Lookups or get Customer Targeted Ads. In this step, you start a session for API access by obtaining a session token.

Step 2: Create customers

Source: Create Customers. In this step, you create one or more customers by making a POST call to this endpoint: /v2/data/customers

Step 3: Retrieve ads

Source: Retrieve Customer Profile Retrieve Customer’s Ad Redemptions Retrieve Customer’s Ad Reward Summary. In this step, you can retrieve ad redemptions for a given customer, retrieve customer profile, and retrieve ads reward summaries for a given customer.

Step 4: Send customer events

Source: Create customer events. In this step, you'll make a POST call and use this endpoint to capture user activity throughout a session.

Step 5: Send customer transactions

Source: Send Customers Transactions. To create customer transactions you make a POST call to this endpoint: /v2/data/transactions.

Step 6: Implement Real-Time Messaging (Webhook)

Source: Implement RTM (Webhook) for Real time Reward notifications. Cardlytics provides you with a Real-Time Messaging (RTM) interface that posts certain events to publishers as soon as they are made available. This can be used to drive various marketing workflows for better engagement with customers and with the offers program.

Step 7: Rewards settlements

Source: Rewards Settlements File Sharing. This describes periodic (default: monthly) reward settlement data for publishers, which is integral to the success of the Cardlytics system because you can use it to provide reward-funding to your customers.

Updated 6 days ago